Navigate the Neighborhood of Home Buying!

4.12.17

Mortgage Options, Inc. is Helping Home Buyers Navigate the Home Buying Process!

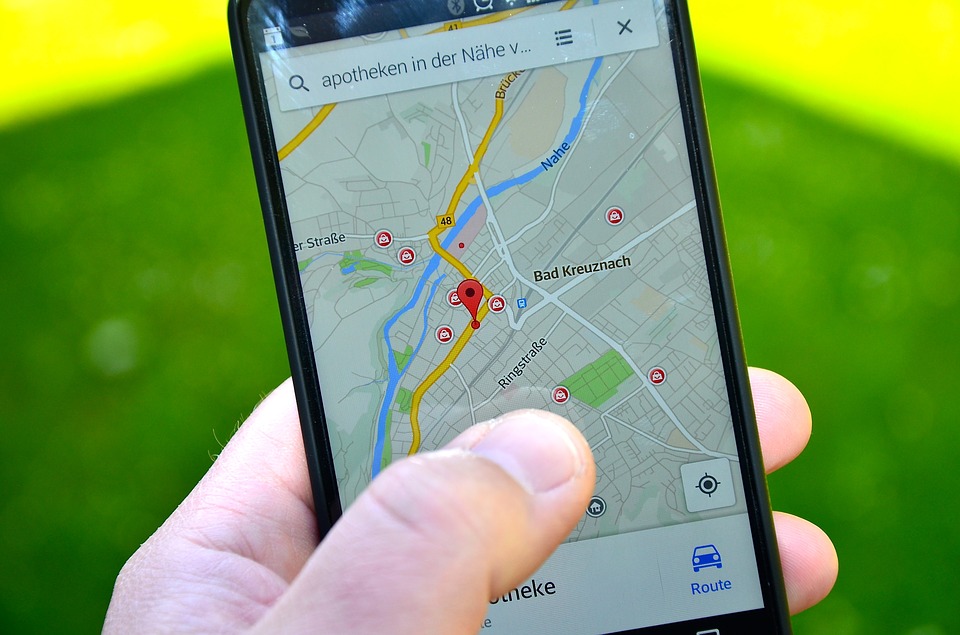

Have you ever driven around an unfamiliar neighborhood and gotten lost? It’s pretty easy to do. If you know someone who lives in the neighborhood, it’s likely they can give you directions to keep you from getting turned around. Navigating the home buying process is similar to getting lost in a new neighborhood. With the right tools and directions, the process is much smoother. Mortgage Options, Inc. knows how tough it can be to navigate the streets in the neighborhood of the home buying process. We know how many lenders there are and the variety of home loans that are available. We understand the frustration of learning about a specific type of loan only to later learn that you don’t qualify for that home loan. We’re here to help. To make the home buying process simpler, we’ve developed the tips below to help home buyers navigate the confusing streets of the home buying process.

How to Make Your Loan Process Move Smoothly

- Make sure your credit is in good shape.

- If you pay rent, use a check to pay for it.

- Obtain proof of employment for the past 2 years.

- Avoid large deposits or withdrawals from your bank account.

- Figure out what you can put forth for a down payment.

- Secure a pre-approval letter from an independent mortgage professional (like Mortgage Options, Inc.).

- Research choices for local real estate agents.

Once you have followed these tips, it is time to start applying for a home loan. Even while you are applying for a home loan, you must take some factors into account.

6 things NOT to Do When Applying for A Mortgage Loan

- Do not purchase major items such as cars, furniture, electronics, or jewelry.

- Don’t switch jobs or quit your current one.

- Consult with your mortgage professional if you need to withdraw, or move money between checking accounts and savings accounts.

- Don’t pay off debts or collections unless you are instructed by your mortgage professional to do so.

- Avoid using cash when making your good faith deposit.

- Don’t have your credit report pulled numerous times.

Now that you are aware of things not to do during the home buying process, you can start to think about loan options. Mortgage Options, Inc. has hundreds of options to choose from, and we can help you make the best choice for your situation. Many banks have only 2 or 3 mortgage loan options. Before sitting down to discuss your options, you will want to have some numbers already in mind.

How Much House Can You Afford?

- What is your monthly income?

- What are your available funds for down payment?

- What are your monthly expenses?

- What is your credit score?

After you have determined your budget, you can narrow down your loan options considerably to determine the choice that is the best for you. You may even qualify for our 1% down conventional loan with equity boost program. This is where the buyer puts down 1% for a down payment, the lender contributes 2% of the down payment, and the homeowner starts with 3% equity at closing.

The most important aspect to securing your home loan is having a professional and knowledgeable mortgage broker guiding you through the tricky neighborhood streets of home buying. Mortgage Options, Inc. is your GPS to the home buying process.