Loans With Zero Percent Down Do Exist!

9.27.16

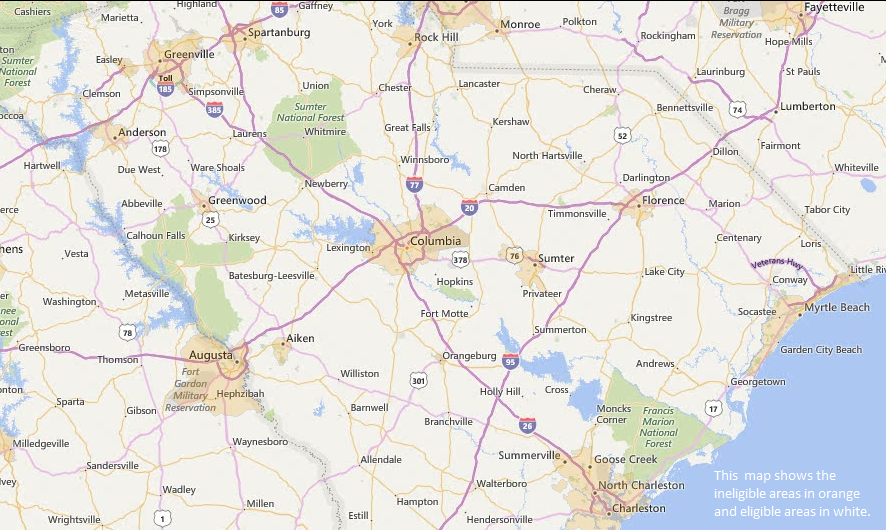

When you hear about a mortgage broker or home ownership do you chuckle to yourself thinking that will never happen for you? Have you thought there would be no possible way to come up with the 5% or 10% down that most lenders are looking for? There are many loan programs that are available for all types of borrowers. The USDA has loan programs to help draw home buyers to more rural areas and increase growth. These loans offer little to no money down and can get you into a home of your dreams. In October 2016 the UDSA has made these loans even more enticing. According to the USDA, “The upfront guarantee fee will change from 2.75% to 1.0% of the loan amount. The annual fee will change from 0.50% to 0.35% of the average scheduled unpaid principal balance for the life of the loan”. This means that the overall cost of this loan will be less beginning October 1st, 2016 than in previous years. Even better, the area you currently reside in may already be one of the qualified areas since many of the areas outside of Columbia are considered rural areas.

Here are a few of the requirements for the program.

According to the USDA applicants must:

• Have income eligibility (click this link for income-eligibility).

• Be a citizen of the U.S., a U.S. non-citizen national, or Qualified Alien.

• Personally occupy the dwelling. It must be the primary residence.

• Be legally capable to incur the loan obligation.

• Show willingness to meet credit obligations in a timely manner.

• Not been suspended or debarred from participation in federal loan programs.

• The property must meet all program criteria.

The funds from this program can be used several different ways:

• Towards new or existing residential property and closing costs.

• For repairs and rehab associated with purchase of an existing dwelling.

• For possible refinancing of eligible loans.

• Towards special design features or permanently installed equipment to help accommodate a family member with a disability.

• For reasonable and customary connection fees and assessments for certain utilities.

• Towards purchasing and installing measures to promote energy efficiency.

• To cover site preparation costs.

• For essential household equipment such as flooring, ovens, refrigerators, washers, dryers, and heating and cooling.

At Mortgage Options, Inc. we can go over the criteria and see if you qualify for this type of home loan with little to no money down. We can also explain the newest changes to this loan which begin on October 1st, 2016. If you are thinking of applying for this type of loan, contact Mortgage Options Inc. and we can explain all of these intricate details to you.